Posts Global Market scrap metal 410 23 May 2025

Decline in supply recorded in the EU

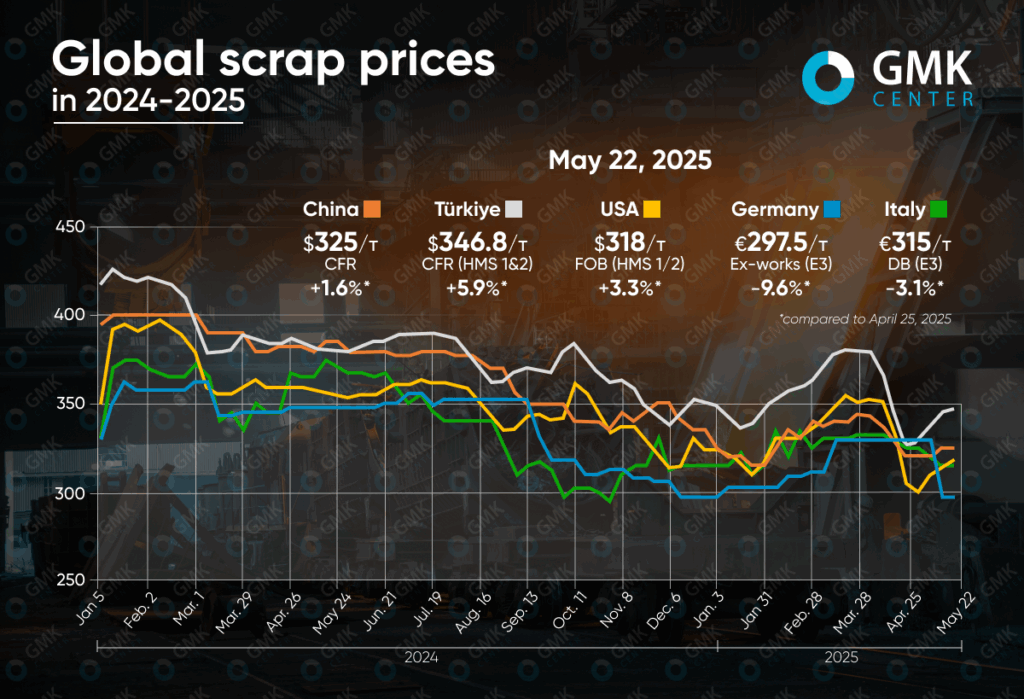

In early May 2025, the scrap market showed a predominantly upward trend. Amid stabilization in the steel sector, rising demand in export destinations and limited supply in some regions, scrap prices began to recover. At the same time, in a number of countries, the market remained under pressure from domestic issues such as overproduction, low margins and weak demand.

Turkey

In May 2025, the scrap market in Turkey revived after a difficult April, when prices plummeted by more than 14%. As of mid-month, prices for HMS 1&2 80:20 recovered to $346.8 per tonne CFR, up almost 6% from the end of April. Sellers were able to raise quotations due to limited supply from the US and EU, rising dock prices and a stable euro, which supported export sentiment.

Despite this, the market remained vulnerable. Turkish steelmakers struggled to contain the growth in purchase prices as domestic demand for steel remained weak, and rebar prices did not show significant growth. Even after selling about 250,000 tons of rebar for export in the first two weeks of May, the domestic market did not improve, as warehouse stocks were already partially replenished and consumer activity declined.

This was compounded by geopolitical uncertainty. Traders were closely following the talks between Russia and Ukraine in Istanbul, as a potential ceasefire could change logistics and market equilibrium. But there was no peaceful breakthrough, and this only added to the tension.

Overall, May was a period of cautious optimism: the market is trying to find a new balance between supply and demand, while global events and economic cues remain crucial factors for price dynamics in the coming weeks.

EU

The European Union’s scrap market remained under pressure from negative factors in early May, which led to a further decline in prices. In Germany, E3 scrap quotations fell by 9.6% to €297.5 per tonne, and in Italy by 3.1% – to €315 per tonne. This reflects the general downward trend in the market that has been going on since April.

The main reasons were weak demand from European steelmakers and limited exports to Turkey and Asia. According to market participants, steel mills are not ready to pay more for raw materials without a significant increase in prices for finished products. This is confirmed by a 10% year-on-year decline in German scrap exports in January-February.

However, the situation has the potential to change. The Turkish market is showing signs of stabilization, and the EU has seen a resumption of plant activity after the April Easter holidays, which is increasing demand for scrap. In France, Germany and Italy, traders have already begun to curb sales volumes, expecting more favorable prices in June. Market participants believe that the bottom has already been reached and predict a slight rise in prices in the near future.

“The Turks have managed to raise rebar export prices by $20/t over the past two weeks, which has led to a recovery in scrap prices. Scrap prices of $340-345/t and rebar prices of $540-550/t provide Turkish steelmakers with a normal margin. In Europe, scrap prices reflect the dynamics in Turkey a month late. Thanks to cheap scrap, Turkish mills have reduced export prices for steel. As a result, cheap imports are putting pressure on prices in Europe, there are problems with sales, and demand is weak. Now European tablemakers are forced to demand cheaper scrap,” comments Andriy Tarasenko, Chief Analyst at GMK Center.

USA

The US scrap market showed mixed dynamics in the first half of May. After a sharp drop of 13.2% in April, prices for HMS 1/2 (80:20) on the US East Coast rose by 3.3% to $318/t FOB. This is partly due to increased exports to Turkey, where American scrap was traded at $337-340/mt CFR, which supported the domestic market.

However, the situation remained tense domestically. Due to oversupply and reduced demand from steel mills, most of them cut purchases by up to 50%. Prices for all major scrap grades dropped by $30-50/t, and in Detroit by up to $50/t due to previously inflated quotations.

Additional pressure was created by cheap imported steel supplies and weak orders for hot-rolled steel, which reduced the profitability of the plants. In the US West, prices for HMS 1/2 also declined, in particular to $280-285/mt CFR Taiwan.

Despite the difficult situation, traders hope for improvement, in particular due to increased exports to Turkey and Mexico, which could partially relieve the oversupplied market, especially in Texas, where the surplus is estimated at more than 100 thousand tons.

China

The Chinese scrap market has shown moderate growth since the beginning of May: domestic prices rose by 2.5% – to $329.9/t, while import prices increased by 1.6% to $325/t CFR. The main factor supporting prices was the stabilization of the situation in the steel sector and the revival of demand for finished products, which stimulated purchases of scrap.

Activity in the domestic market was boosted by low inventories held by steelmakers. Data show that daily deliveries to 255 enterprises increased by 2.86%, but still do not cover the average daily consumption (545.5 thousand tons), which put additional pressure on the market.

Despite this, Chinese mills continue to be cautious in their purchases: the cost of scrap remains higher than the price of pig iron, and the margin of steel production is expected to decline. Most companies are working “to order,” reducing inventories.

Activity in the import market also grew, albeit moderately. In particular, purchasing interest in Japanese scrap was low due to currency fluctuations and uncertainty over the updated national standard for imported scrap. This keeps some traders on hold, limiting transaction volumes.